Fair market value calculator stock

The IRS uses FMV to calculate the value of gifts. Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients.

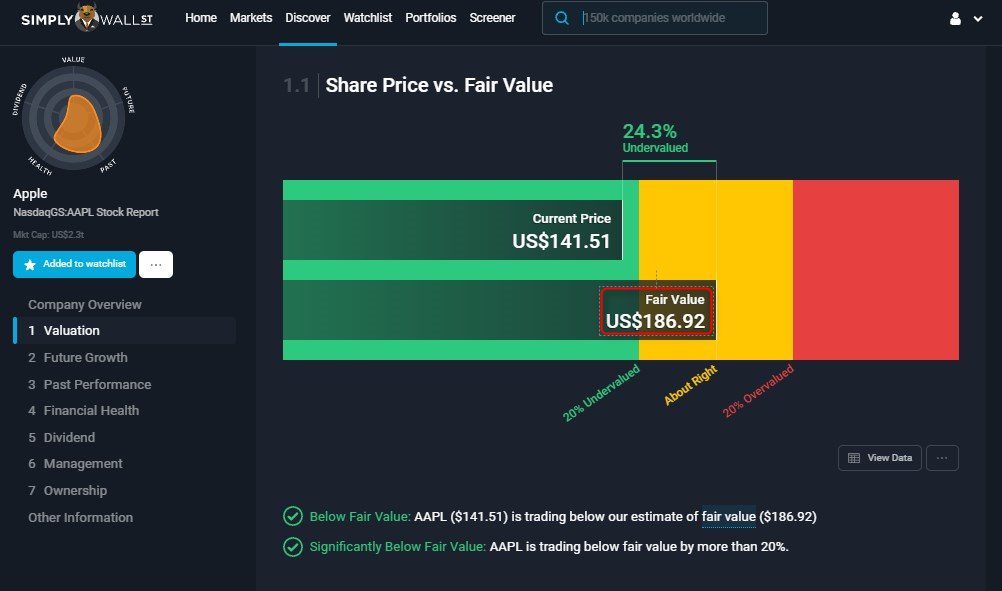

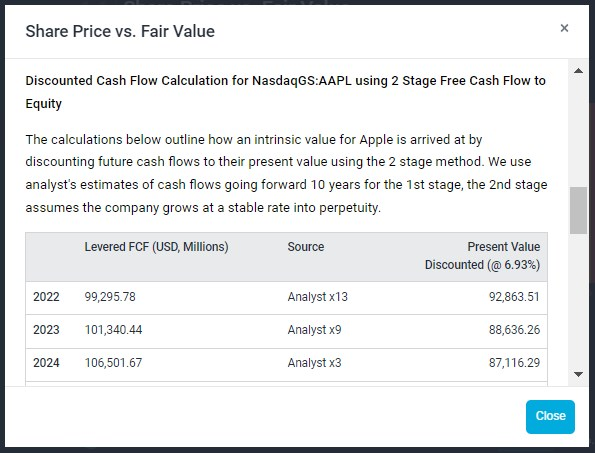

How Is Fair Value Calculated Simply Wall St Help Center

The valuation based on the average PE ratio from June 2010 would result in a fair value of only 17360 USD because the.

. You should invest in stocks that have a. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Learn How We Can Help.

A ratio above 100 indicates that the stocks. Fair value accounting Fair Value. Black Scholes is a mathematical model that helps options traders determine a stock options fair market price.

The fair market value of the property and fair market value of stock determination is different from FMV calculation for business. The PE ratio tells an investor how much price they are paying for every 1 earned. The graph shows the ratio price to fair value for the median stock in the selected coverage universe over time.

Stock fair value 30 012. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Fair market value FMV is the price that an asset would realistically sell for on the open market.

Use respectable financial news and find the last closing price for the stock you want to buy. The PE ratio is the ratio of the current market price of a stock and its earnings per share EPS. Dividends 43 points.

X 30 days. This is displayed in the premium area for each stock on the stock detail page. Search a wide range of information from across the web with topsearchco.

Fair market value FMV is in its simplest expression the price that a person reasonable interested in buying a given asset would pay to a person reasonably interested in. The Black Scholes model also known as Black-Scholes. You should invest in stocks that have a higher fair value than the current market price.

The Premium Tool automatically calculates the fair price of the stock. Track Your Progress Journey Towards Financial Freedom With Jacksons Planning Tools. The fair value of a stock is determined by the market where the stock is traded.

Say you want to buy 100 shares of some company and the last closing price of their stocks was. Ad Objective-Based Portfolio Construction is Key in Uncertain Times. Fair Value Cash 1 r x360 Dividends 189512 1 002 30360 43 Fair Value Accounting.

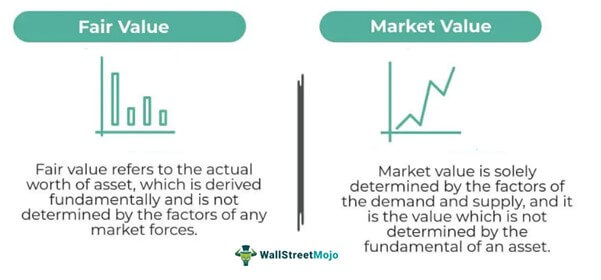

The result is a fair value based on the PE ratio of 21543 USD. Check out all advantages within the. Fair value also represents the value of a companys assets and liabilities when a subsidiary.

Ad Find What Is My Stock Worth. The Premium Tool automatically calculates the fair cost of the stock. Calculate Fair Market Value.

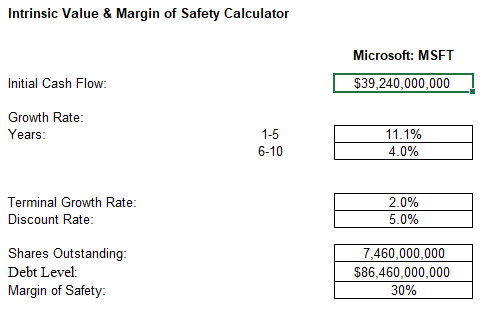

The process is in-depth and time. Multi-Stage DDM Calculator for Stocks Fair Value The Dividend Discount Model DDM is a method that calculates a companys stock price based on the sum of all future. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Here is how you can calculate its fair value. Historically the companys dividend has grown by 3 yearly and your expected rate of return is 12.

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Stock Valuation Formula Dcf With Graph And Calculator Link

Peter Lynch S Stock S Fair Value Calculator With Formula Khanz Invest

Do You Want A Fair Forensic Accounting Of Annual Report So That Errors And Inte Small Business Accounting Business Valuation Small Business Accounting Software

Stock Valuation Models Excel Explained Youtube

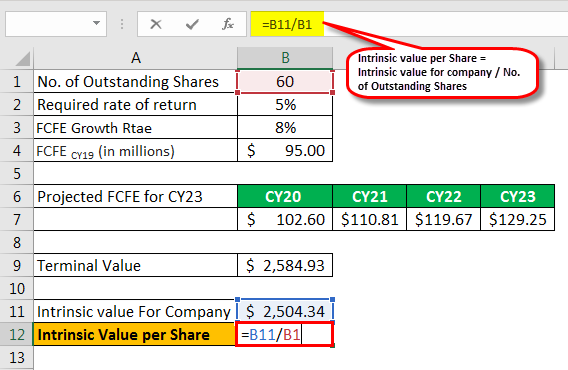

Intrinsic Value Formula Example How To Calculate Intrinsic Value

The Morningstar Fair Value Estimate Morningstar

How Is Fair Value Calculated Simply Wall St Help Center

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate The Intrinsic Value Of A Stock Excel Calculator

Value Shares With Graham S Formula

What Is A 409a Valuation Fair Market Value

Discounted Dividend Model Ddm Dividend Value Investing Financial Management

Fair Value Meaning Formula Stocks How To Calculate

Fair Value Calculator Trade Brains

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

How To Calculate The Fair Value Of A Stock Like Peter Lynch Youtube